Management

Message from Top Management

Corporate Governance

Basic Policies and Systems

SHIMA SEIKI places great importance on enhancing corporate governance to improve management efficiency, soundness, and transparency while at the same time conducting management that emphasizes the interests of stakeholders such as shareholders, customers, business partners, and employees. By fully utilizing the functions of the Board of Directors and the Audit & Supervisory Board Members, we will strive to build a system that enables proper and effective corporate governance.

Fundamental Policy for Corporate Governance

Chapter 1: General provisions

- Article 1 (Purpose)

-

The Fundamental Policy for Corporate Governance (hereinafter referred to as the “Fundamental Policy”) stipulates the fundamental policy for corporate governance at Shima Seiki MFG, Ltd., (hereinafter referred to as the “Company”) for the purpose of maintaining the Company’s continuous growth and improving its medium-to-long-term corporate value.

- Article 2 (Fundamental points of view for corporate governance)

-

Based on the corporate philosophy “Ever Onward – Limitless Progress,” the Company intends to increase the trust of shareholders and other stakeholders, maintain the Company’s continuous growth, and improve medium-to-long-term corporate value. For that reason, as one of our most important tasks, we will ensure management soundness, transparency, and efficiency, and we will take the initiative to enhance corporate governance.

-

Love:

We aim to create world's firsts through our finely honed sensitivity and sense of creativity.

-

Creativity:

We aim to create world's firsts through our finely honed sensitivity and sense of creativity.

-

Passion:

We tackle new challenges with passion and chart our own future course by putting our all into our products and services.

【Corporate Philosophy】

Ever Onward ― Limitless progress

We strive to become an indispensable company to society through sustainable business development. We do this under the motto of “Ever Onward” with “Love,” “Creativity,” and “Passion” as our mantra.

-

Chapter 2: Ensuring shareholder rights and equality

- Article 3 (Ensuring shareholder rights)

-

The Company is sufficiently aware of the importance of shareholder rights and will obey all laws and ordinances with regard to appropriate handling so that shareholder rights and equality will be substantially ensured. In addition, the Company will fully consider the exercise of rights as allowed for minority shareholders.

- Article 4 (General meetings of shareholders)

-

The Company is aware that the general meeting of shareholders is the Company’s highest decision-making body and will thus strive to maintain an environment where shareholders have a sufficient period for properly exercising those rights.

- In principle, the date for a general meeting of shareholders will be set by avoiding dates when many companies hold shareholders’ meetings in order to have as many shareholders as possible attend the general meeting of shareholders and to thereby bring about constructive dialogs with shareholders.

- For the information considered necessary for shareholders to appropriately exercise their rights at a general meeting of shareholders, we will strive to enhance the provision of information through the notification of the convocation of the general meeting of shareholders, reference documents, and business reports. In addition, in order for shareholders to have sufficient time to consider all issues for debate at a general meeting of shareholders, we will send the notification of the convocation approximately three weeks before the date of the general meeting of shareholders. Before sending the notification, we will disclose the agenda on the Company’s website.

- In order for institutional investors and shareholders from other countries to conveniently exercise their rights, we will use an electronic method or platform for the electronic exercise of voting rights and provide an English translation of the notification of the convocation of the general meeting of shareholders.

- For an issue for debate that was proposed by the Company and that received a considerable number of opposing votes at a general meeting of shareholders, the Board of Directors will analyze the reasons for the opposition and the reasons for the many opposing votes, and consideration will be given as to whether or not it is necessary to conduct future dialogs with shareholders or other handling.

- Article 5 (Capital policy)

- The Company is aware of the capital policy as an important management task and will strive to practice efficient management with regard to earning power and capital efficiency and aim to strengthen a sound financial structure and continue investment for the purpose of growth.

- For returns to shareholders, the fundamental policy is to provide stable dividends over a long period through sustained development of business, while comprehensively considering share price levels, the capital situation, and the market environment. The Company will strive to improve capital efficiency through the acquisition of its own shares.

- Article 6 (Cross-shareholdings)

- In the event that it will contribute to the Company’s continuous growth and improve its medium-to-long-term corporate value through business-related importance and maintain, strengthen, and link transaction relationships, the Company will possess shares of its transaction partners. For stocks and securities for which the significance of possession is not necessarily sufficient, we will curtail such possession.

- For individual cross-shareholdings each year, the Board of Directors will comprehensively consider the risks of possessing those cross-shareholdings and advantages by maintaining, strengthening, and linking transaction relationships, use a medium-to-long-term perspective to verify the rationality of possessing cross-shareholdings, and make decisions about maintaining or curtailing possession. In addition, for the exercise of voting rights related to cross-shareholdings, the Board of Directors will carefully examine the issues for debate, make a judgment about whether or not it will improve shareholder value, and then appropriately exercise those voting rights.

- Article 7 (Transactions with related parties)

- In the event the Company will conduct a transaction with a director of the Company, a corporation that a director of the Company substantially controls, or with a principal shareholder, the Company shall submit the matter to the Board of Directors in advance for approval and then report the results of that transaction as necessary.

- For transactions with related parties, appropriate disclosure will be made by following laws and ordinances.

Chapter 3: Appropriate cooperation with stakeholders

- Article 8 (Code of conduct)

-

Based on the philosophy stated in Article 2, the Company will build even better relationships with stakeholders, provide appropriate cooperation. In order to ensure that each individual within the Company acts based on sound judgment with a strong sense of ethics as a member of society, we will stipulate and comply with the Shima Seiki Group Cord of Conduct.

- Article 9 (Sustainability)

- The Company aims for manufacturing that is friendly to both people and the environment. As a global corporation, the Company will contribute to the realization of a sustainable society through the development and provision of products and services that consider the environment.

- For environmental preservation activities, we will establish a committee of experts, promote business activities in consideration of the environment, stipulate guidelines for environmental actions, and ensure that each individual employee is always aware of environmental preservation while working.

- Article 10 (Ensuring diversity)

-

Because diverse values and specializations are essential for strengthening management skills and continuous growth, the people in the Company will mutually respect diverse human resources, irrespective of nationality, gender, and age. In addition, the Company will strive to promote diversity and foster an organizational climate where it is possible to truly experience job satisfaction and growth.

- Article 11 (Whistleblowing system)

-

For cases in which a violation of the law or other important fact related to compliance is discovered, the Company will maintain and appropriately operate a system in which reporting or whistleblowing is possible through the Corporate Ethics Helpline, in addition to the ordinary reporting route, as part of the internal control system. Any person reporting such violations shall be protected from disadvantageous handling or retaliation because of such whistleblowing reports.

- Article 12 (Role as the asset owner for corporate pension)

-

The Company will adopt a defined-benefit corporate pension system, and in relation to management and the operation of corporate pensions will consign management to multiple investment organizations that have declared acceptance of stewardship activities. For the selection of places of investment in the operation of pension assets and the exercise of voting rights for that selection, we will follow the judgment criteria of the consigned investment organizations and ensure that conflicts of interest do not arise between corporate pension beneficiaries and the Company. In addition, in order to strive for appropriate management of corporate pensions, we will work to improve the quality of the people in charge through external training sessions. In addition, the Company will also regularly obtain reports on the soundness of the operation from the consigned investment organizations, appropriately monitor the related departments, and confirm the state of the operation.

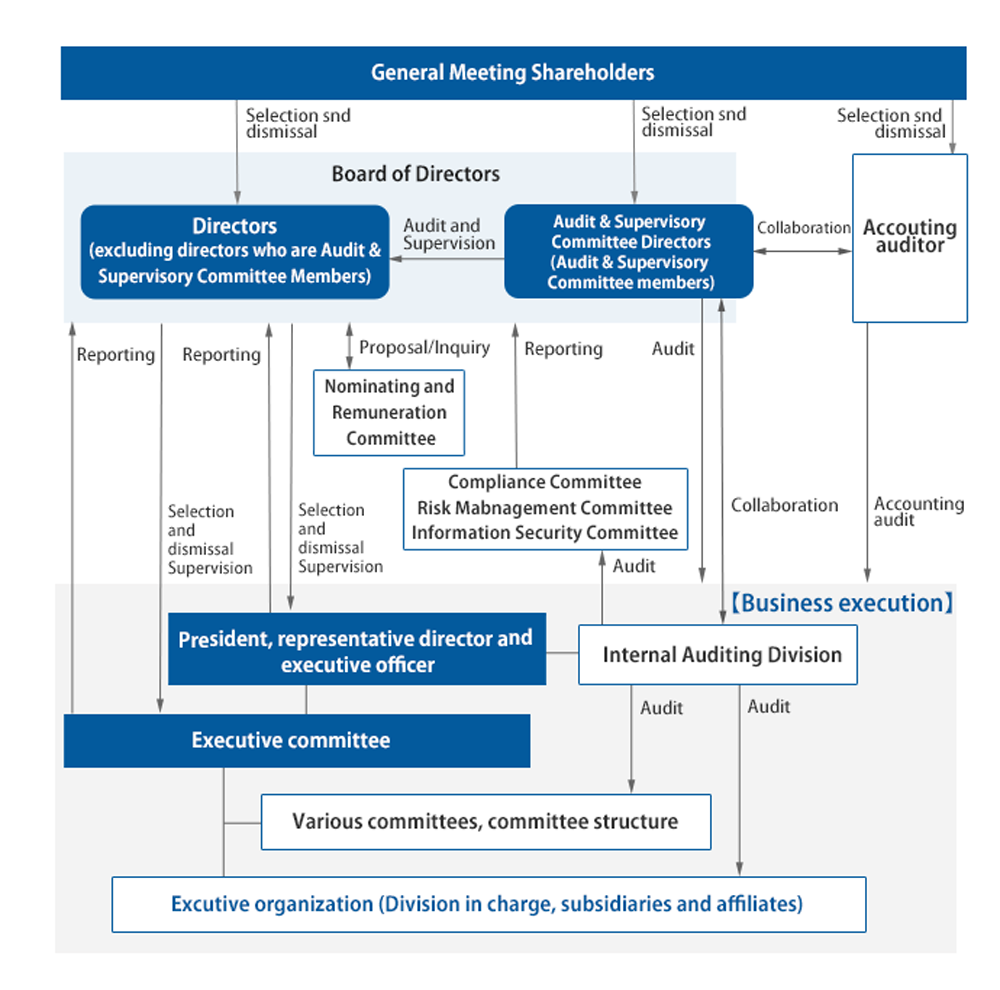

Chapter 4: Corporate governance system

- Article 13 (Organizational design)

- As an organizational design based on the Companies Act, the Company will have an Audit and Supervisory Committee, the Board of Directors will make the important decisions on management and the supervision of work execution, and the Company will strive to further strengthen the auditing and supervision functions by ensuring that the directors who are Audit and Supervisory Committee members have voting rights on the Board of Directors.

- The Company will introduce an executive officer system, work to expedite business management, and improve efficiency by separating management’s supervision functions from work execution functions.

- As an advisory body to the Board of Directors, the Company will have a Nomination and Remuneration Committee wherein at least half of the members are outside directors. Additionally, the Company will strive to further enhance corporate governance by ensuring transparency, fairness, and objectivity for matters related to the directors’ election, dismissal, and plans for successors and for matters related to remuneration and other treatment.

- Article 14 (Composition of the Board of Directors)

- In accordance with the Articles of Incorporation, the Board of Directors will consist of up to ten directors (excluding directors who are Audit and Supervisory Committee members) and up to five directors who are Audit and Supervisory Committee members. In addition, in principle, at least one-third of the directors shall be independent outside directors.

- The Board of Directors will consist of people with diverse knowledge, experience, and skill in order to ensure the appropriate diversity and scale, including the expertise, skills, gender, and global aspects that are necessary for the Board of Directors as a whole.

- Article 15 (Roles and obligations of the Board of Directors)

- In order to promote the Company’s continuous growth, improve medium-to-long-term corporate value, and strive to improve earning power and capital efficiency, the Board of Directors will establish a philosophy and then make decisions about the management strategies and management plans to create and operate an appropriate system and structure for corporate governance. Furthermore, the Board of Directors will supervise the execution of duties by directors and executive officers, in addition to making decisions for matters stipulated under current laws, ordinances, and the Articles of Incorporation and other important matters for management.

- For the supervision and decisions of Article 15.1, the Board of Directors will use a strong code of ethics from an independent and objective position to sincerely conduct its work, actively declare opinions, and thoroughly conduct constructive discussions.

- Article 16 (Operation of meetings of the Board of Directors)

- The Board of Directors’ secretariat will send the issues submitted for discussion and related materials with a sufficient amount of time before the date of any meeting and will provide advance explanations as necessary, so that the people who will attend the Board of Directors’ meeting will be able to prepare in advance.

- The annual schedule for meetings of the Board of Directors and the issues that are expected to be submitted for discussion will be decided in advance, and the directors will be notified.

- Meetings of the Board of Directors will be held once each month, in principle, and extraordinary meetings will be convened as necessary.

- Article 17 (Composition of the Audit and Supervisory Committee)

- In accordance with the Articles of Incorporation, the Audit and Supervisory Committee will consist of up to five directors who are Audit and Supervisory Committee members, and a majority of those directors must be outside directors. It will also be possible to elect standing Audit and Supervisory Committee members by a resolution adopted by the Audit and Supervisory Committee.

- Meetings of the Audit and Supervisory Committee will be held once each month, in principle, and will also be held whenever necessary.

- Article 18 (Roles and obligations of the Audit and Supervisory Committee)

- As a body with the authority to investigate the work and accounting, the Audit and Supervisory Committee will conduct audits of the execution of directors’ duties and create audit reports.

- In order to ensure appropriate audits by the accounting auditors, the Audit and Supervisory Committee will decide on the issues for debate in relation to the election, dismissal, and non-reappointment of accounting auditors.

- The Audit and Supervisory Committee will determine the Audit and Supervisory Committee’s opinions about the election, dismissal, resignation, and remuneration for directors other than Audit and Supervisory Committee members.

- For the purpose of effective audits, Audit and Supervisory Committee members can regularly exchange opinions with representative directors, accounting auditors, and the Internal Audit Office, respectively.

- Article 19 (Election and dismissal of directors)

- The candidates for election as directors (excluding directors who are Audit and Supervisory Committee members) shall be people who have the knowledge, experience, skills, and expertise to effectively carry out the roles and obligations of directors so that the Board of Directors will be comprised in a form that is balanced in terms of proper diversity and scale. In addition, directors who are independent outside director candidates shall include people who fulfill the Tokyo Stock Exchange’s independence criteria and the Company’s criteria for the independence of outside directors (refer to ※1) and who have management experience. Furthermore, director candidates for election to the Audit and Supervisory Committee members shall be people who can bring diversity to the Audit and Supervisory Committee and shall include people who have appropriate knowledge related to finance and accounting.

- For the nomination of director candidates, representative directors, and directors with titles, the Nomination and Remuneration Committee will conduct deliberation, a report of the findings of that deliberation will be obtained, and a decision will be made by a resolution adopted by the Board of Directors. For director candidates who are Audit and Supervisory Committee members, agreement by the Audit and Supervisory Committee shall be obtained.

- When a director, representative director, or director with a title has violated a law, ordinance, or the Articles of Incorporation, or any other reason has arisen that may damage the Company’s corporate value, the Nomination and Remuneration Committee shall discuss the dismissal from the position or dismissal from employment.

- Article 20 (Directors’ remuneration)

- Remuneration for directors (excluding directors who are Audit and Supervisory Committee members) will be in accordance with each director’s role and responsibilities, and a remuneration system that increases directors’ incentives will be used for the purpose of maintaining the Company’s continuous growth and improving its medium-to-long-term corporate value. Directors’ remuneration based on that system will be the basic remuneration, director bonuses shall be linked to the business results of the relevant business year as short-term incentives, and share remuneration shall be included as medium-to-long-term incentives.

- Outside directors’ remuneration will be only basic remuneration from the perspectives of such directors’ roles and independence.

- Directors who are Audit and Supervisory Committee members will receive only basic remuneration in light of the directors’ roles.

- In order to increase transparency and objectivity with regard to the remuneration of directors, the Nomination and Remuneration Committee will conduct deliberation, a report of the findings of that deliberation will be obtained, and then a decision will be made.

- For remuneration of directors who are Audit and Supervisory Committee members, each person’s remuneration will be determined after discussions by the committee and consideration of the person’s duties and whether the person works full time or part time.

- Article 21 (Board of Directors’ evaluation of effectiveness)

-

In order to further increase the effectiveness of the Board of Directors, once each year the Board of Directors will refer to the self-evaluation conducted by each director and conduct an analysis and evaluation related to the effectiveness of the Board of Directors as a whole, and then the Board will disclose a summary of those results.

- Article 22 (Training for directors)

-

In order for directors to appropriately carry out the expected roles and obligations, the Board of Directors will encourage the directors to appropriately acquire and update the necessary knowledge. The Board of Directors will provide training opportunities and mediation and support for the necessary expenses for those purposes. In addition, outside directors will be provided with opportunities for explanation of business content and exchanges of opinions so that they gain a deeper understanding of the Company’s business.

- Article 23 (Acquisition of information, and support system)

- Directors will actively work to collect information in order to effectively carry out their roles and obligations.

- The Board of Directors will have a secretariat, proper members will be assigned, and support for the provision of the necessary information will be provided.

- Directors will, as necessary, provide support so that advice can be obtained from external experts, such as outside attorneys.

- Article 24 (Accounting auditors)

- By having the accounting auditors audit the accounting documents, the Company will be aware that it bears an important role for ensuring transparency and shareholders’ trust in the Company’s management, and it will appropriately cooperate in order to ensure proper audits.

- Confirmation of audit plans will be conducted between the Audit and Supervisory Committee and the accounting auditors, reports about the audit results of the Company and its consolidated subsidiaries will be obtained regularly, mutual information exchanges by requesting reports will be conducted as necessary, and efforts will be made to closely collaborate to improve the effectiveness and efficiency of audits.

Chapter 5: Appropriate information disclosure, and dialogs with shareholders

- Article 25 (Enhancement of information disclosure)

-

In order to ensure the trust of shareholders and other stakeholders, the Company will appropriately disclose financial and nonfinancial information based on laws and ordinances, and for information other than as required by laws and ordinances, we will provide timely and fair disclosure of information that the Company judges useful for stakeholders.

- Article 26 (Constructive dialogs with shareholders and investors)

-

The Company promotes constructive dialogs with shareholders and investors based on the disclosure policy in order to maintain continuous growth and improve medium-to-long-term corporate value.

- The Company’s spokespeople related to IR will be the Company president, the director in charge of accounting and finance, the person responsible for information disclosure (the director in charge of general affairs and personnel), and the person in charge of IR.

- The General Affairs and Personnel Department, which is the department in charge of IR, will appropriately cooperate with the Accounting and Finance Department, promote IR activities based on collaboration with related departments, and support the management team’s dialogs with shareholders and investors.

- For IR activities, the Company will provide individual meetings and conference calls with shareholders and investors, financial results briefings (after end-of-term and second-quarter announcement of financial results) for analysts and investors, and company information sessions for individual investors. In addition, we will dispatch information that is easy to understand by using various forms, such as the homepage and disclosure materials, and strive to promote dialogs with shareholders and investors.

- For opinions and requests that were ascertained through dialogs, we will strive to provide feedback to the management team and related departments and share information as necessary.

- For insider information, appropriate management will be conducted based on regulations to prevent insider trading.

Chapter 6: Establishment, revision, and abolition

- Article 27 (Establishment, revision, and abolition)

-

Establishment, revision, and abolition of the Fundamental Policy require a resolution adopted by the Board of Directors.

- (Supplementary provisions)

- Enacted on January 29, 2021

※1: Criteria Concerning the Independence of Outside Directors

In order to maintain a high level of independence from the Company, the Company’s outside directors shall fulfill all of the requirements below.

- The person is not or was not, either currently or in the past ten years, a business executor(Note 1) of the Company or an affiliated company of the Company (hereinafter referred to as the “Company Group”).

- The person does not or did not, either currently or in the past three years, fall under any of the conditions below.

- A person who uses the Company Group as a main transaction party(Note 2) or that person’s business executor

- A main transaction partner of the Company Group(Note 3) or that person’s business executor

- A major shareholder (a person who directly or indirectly possesses 10% or more of all of the voting rights) of the Company or that person’s business executor

- A business executor of a party for which the Company Group is a major shareholder (directly or indirectly possesses 10% or more of all of the voting rights)

- A consultant, certified public accountant or other accounting expert, or attorney or other legal expert who obtains a large amount of money or other assets(Note 4) other than director remuneration from the Company Group (In the event that the party obtaining the relevant assets is a corporation or a union, this refers to a person who belongs to that organization.)

- A person who receives donations in the form of a large amount of money or other assets(Note 4) from the Company Group or that person’s business executor

- When the Company Group’s business executor has taken a position as an external director at another company, that other company’s business executor

- In the event a person who falls under one of the items of (1) through (7) above is an important person, that person’s spouse or relative within the second degree

- A spouse or relative within the second degree of a director (excluding outside directors) of the Company Group or a person who executes important work, such as a person in charge of a department

- The person does not have other circumstances for which it will be rationally judged that the person cannot perform duties as an independent outside director.

- (Note 1) A business executor refers to a person who executes work, such as a corporation or other organization’s managing director, executive officer, executive director, employee who executes work, or another similar executive or employee.

- (Note 2) A person who uses the Company Group as a main transaction partner refers to a person for which the amount of transactions with the Company Group exceeds either an annual amount of JPY 100,000,000 or 2% of its consolidated sales.

- (Note 3) A main transaction partner of the Company Group refers to a person for whom the amount of transactions with the Company Group exceeds either an annual amount of JPY 100,000,000 or 2% of the Company Group’s consolidated sales or a person who is providing financing to the Company Group for an amount that exceeds 2% of the Company Group’s total amount of consolidated assets.

- (Note 4) A large amount of money or other assets refers to the total amount of that value exceeding an annual amount of JPY 10,000,000 in a case of an individual or 2% of annual sales in a case of an organization.

Governance Structure

Directors/Board of Directors

The board of directors consists of 9 people, including 4 outside directors. As a general rule, the Board of Directors meets at least once each month, flexibly as needed, to deliberate on matters stipulated by law and important management matters, determine management policies, and supervise the execution of business. In 2022 the Board of Directors met 13 times.

Executive/Executive Committee

By separating management decision-making and the supervisory function from the business executing function, we aim to clarify responsibility for business execution, to enhance the supervisory function over the Board of Directors, and to increase management efficiency by accelerating decision-making. The Executive Committee, comprised of nine executive officers, meets at least once each month.

Nomination/Remuneration Committee

As an optional advisory body of the Board of Directors, we established a Nomination/Remuneration Committee chaired by an outside director and more than half of the committee members consisting as outside directors, to make efforts to raise the objectivity and transparency of nomination and remuneration.

Audit and Supervisory Committee Members/Audit and Supervisory Committee

Audit and Supervisory Committee consists of three directors who are Audit and Supervisory Committee Members, including two outside directors who have specialized knowledge in legal affairs, finance and accounting.

Internal Auditing Division

SHIMA SEIKI established an Internal Auditing Division to perform internal audits throughout the company's business operations, as well as to conduct internal control audits that determine the status of compliance, risk management, and financial reporting, based on an annual audit plan.

Accounting audits

The Ohtemae Audit Corporation has been appointed as SHIMA SEIKI's accounting auditor. Regular accounting audits and internal control audits of the company by the auditing firm enhance the effectiveness of the audit system.

-

Criteria Concerning the Independence of Outside Directors

In order to maintain a high level of independence from the Company, the Company’s outside directors shall fulfill all of the requirements below.

- The person is not or was not, either currently or in the past ten years, a business executor(Note 1) of the Company or an affiliated company of the Company (hereinafter referred to as the “Company Group”).

- The person does not or did not, either currently or in the past three years, fall under any of the conditions below.

- A person who uses the Company Group as a main transaction party(Note 2) or that person’s business executor

- A main transaction partner of the Company Group(Note 3) or that person’s business executor

- A major shareholder (a person who directly or indirectly possesses 10% or more of all of the voting rights) of the Company or that person’s business executo

- A business executor of a party for which the Company Group is a major shareholder (directly or indirectly possesses 10% or more of all of the voting rights)

- A consultant, certified public accountant or other accounting expert, or attorney or other legal expert who obtains a large amount of money or other assets(Note 4) other than director remuneration from the Company Group (In the event that the party obtaining the relevant assets is a corporation or a union, this refers to a person who belongs to that organization.)

- A person who receives donations in the form of a large amount of money or other assets(Note 4) from the Company Group or that person’s business executor

- When the Company Group’s business executor has taken a position as an external director at another company, that other company’s business executor

- In the event a person who falls under one of the items of (1) through (7) above is an important person, that person’s spouse or relative within the second degree

- A spouse or relative within the second degree of a director (excluding outside directors) of the Company Group or a person who executes important work, such as a person in charge of a department

- The person does not have other circumstances for which it will be rationally judged that the person cannot perform duties as an independent outside director.

(Note 1) A business executor refers to a person who executes work, such as a corporation or other organization’s managing director, executive officer, executive director, employee who executes work, or another similar executive or employee.

(Note 2) A person who uses the Company Group as a main transaction partner refers to a person for which the amount of transactions with the Company Group exceeds either an annual amount of JPY 100,000,000 or 2% of its consolidated sales.

(Note 3) A main transaction partner of the Company Group refers to a person for whom the amount of transactions with the Company Group exceeds either an annual amount of JPY 100,000,000 or 2% of the Company Group’s consolidated sales or a person who is providing financing to the Company Group for an amount that exceeds 2% of the Company Group’s total amount of consolidated assets.

(Note 4) A large amount of money or other assets refers to the total amount of that value exceeding an annual amount of JPY 10,000,000 in a case of an individual or 2% of annual sales in a case of an organization.

-

Ensuring the Effectiveness of the Board of Directors

At the Company, the number of directors (excluding directors who are Audit and Supervisory Committee members) should be 10 or less, and the number of directors who are Audit and Supervisory Committee members should be 5 or less so that the functions of the Board of Directors can be effectively and efficiently exerted. It is structured so that the balance and diversity of knowledge, experience, abilities, expertise, etc. of the Board of Directors as a whole are ensured.

With respect to independent outside director among directors, in order to contribute to sustainable growth of the company and improvement of the medium- to long-term corporate value, careful consideration should be given to appropriate number of people (more than one-third) so that they can satisfy the standards concerning the independence of outside officers and fulfill required roles and responsibilities. Also, candidates for outside directors shall include those who have management experience.

Currently there are six directors(excluding directors who are Audit and Supervisory Committee members), two of whom are independent outside directors and business executives in different business fields. There are three directors who are Audit and Supervisory Committee members, two of whom are independent outside directors, with expert knowledge in finance, accounting, and legal fields respectively.

In terms of diversity, regarding gender, two female directors are currently appointed. In terms of internationality, a highly experienced director is appointed.

In addition, we analyze and evaluate the effectiveness of the Board of Directors every year.

-

Evaluation method

A questionnaire was distributed to directors and the Audit and Supervisory Board Members who used a graded evaluation and comments to evaluate the effectiveness of the Board of Directors. The results were analyzed and assessed by the Board of Directors. -

Overview of evaluation results

Evaluation results determined that the Company's Board of Directors generally functioned suitably overall and provided appropriate supervision through deliberation and discussion. Therefore, the Board of Directors was deemed effective as a whole. On the other hand, as initiatives aimed at further raising effectiveness in the Board of Directors, we are maintaining awareness regarding the following issues:- Composition of the Board of Directors (number and diversity of directors)

- Enhancement of discussions concerning our medium- to long-term management strategies

- The appropriateness of our directors' remuneration system

- Enhancement of discussions concerning risk management

-

Future response

Based on these evaluation results, the Company's Board of Directors will conduct further review aimed at enhancing and stimulating discussion within the Board of Directors and will work to further increase its effectiveness. In response to the issues listed above, we are promoting various measures such as reducing our number of directors by adopting an executive officer system and establishing a Nomination/Remuneration Committee.

-

Evaluation method

-

Policies and Procedures for Determining Director Remuneration

Remuneration of directors is set as remuneration according to the roles and responsibilities of each director and as a remuneration system to raise incentives for directors to improve the Company's sustainable growth and medium- to long-term corporate value. As a result, director remuneration comprises fixed remuneration and a director incentive remuneration linked to performance in the applicable fiscal year. Stock options are also incorporated into remuneration to function as medium- to long-term incentive remuneration. Moreover, outside director remuneration is fixed remuneration only, based on consideration for the director's role and independence.

In determining director remuneration, we will deliberate at the Nomination/Remuneration Committee, chaired by an outside director, in order to enhance its transparency and objectivity, and upon resolution of the Board of Directors, it will be determined.

-

Strategic Shareholdings

We engage in strategic shareholdings when they are determined to contribute to the Company's sustainable growth and enhance the medium- to long-term corporate value through importance to the business or trade relation maintenance, enhancement, or cooperation.

We will try to reduce the stocks that are deemed not necessarily meaningful enough.

Every year, the Board of Directors considers comprehensively the risks that are held by individuals and the profits obtained through the maintenance, enhancement, or cooperation of transaction relationships, and it will verify the rationality of holding the strategic shareholdings from the perspective of medium- to long-term and determine whether to keep or reduce ownership.

With regard to the execution of voting rights involved with strategic shareholdings, proposals are carefully examined and executed appropriately after determining whether or not they contribute to an increase in shareholder value.

-

Transactions Between Related Parties

In the event of transactions conducted with Shima Seiki directors, legal entitles materially controlled by Shima Seiki directors or major shareholders, the matter is referred to the Board of Directors in advance to obtain approval, and for the approved transactions the results shall be reported.

-

Policies Concerning Constructive Interaction with Shareholders

The Company promotes constructive interaction with shareholders and investors to support improving medium- to long-term corporate value and sustainable growth.

Contents of policy

Policies Concerning Constructive Interaction with Shareholders- In accordance with our disclosure policy, our president, accounting director, information disclosure officer (director of general affairs and personnel), and IR representative will serve as spokespersons for IR related matters.

- The General Affairs and Personnel Division, the department in charge of IR, will promote IR activities and support the management team's interaction with shareholders and investors through appropriate cooperation with the Accounting and Finance Division and collaboration with other relevant divisions.

- Except during quiet periods, the Company will conduct individual meetings with shareholders and investors, teleconferences, briefings for analysts and investors (at term ends and after second quarter earning announcements) and company information sessions for individual investors. We will also disseminate information in a way that is easy to understand through channels such as our homepage and disclosure documents. Through these IR activities, we will aim to promote interaction with shareholders and investors.

- We will promote information sharing by providing feedback concerning opinions and demands discovered through interaction to the management team and related divisions as needed.

- The Company will appropriately manage insider information according to regulations to prevent insider trading.

Internal Control System

Recognizing the importance of creating and operating an internal control system to realize our corporate philosophy and targets, we have formulated and are pursuing basic policies related to improvement of the Internal Control System. Additionally, for effective internal control, we have established a Compliance Committee, a Risk Management Committee, and an Information Security Committee in an effort to enhance internal controls. With regard to internal control over financial reporting, we have systems in place to promote fair and impartial disclosure, thereby ensuring the reliability of financial reporting.

Basic policies related to improvement of the Internal Control System

The Company has resolved at the Board of Directors as follows as "Basic policies related to improvement of the Internal Control System."

- System for ensuring that the execution of duties by directors and employees conforms to laws and regulations and the articles of incorporation

- Directors and employees shall comply with laws and regulations, the articles of incorporation, and social norms based on the "SHIMA SEIKI Group Code of Conduct."

- Under the Compliance Committee, we will promote compliance across the SHIMA SEIKI Group.

- In case of discovering important facts concerning law violation or other compliance, in addition to the usual reporting route, we have a system that reports and informs through the Corporate Ethics Helpline targeting group companies as well. The person who made the report shall not receive disadvantages due to the report.

- To ensure the reliability of financial reporting and achieve appropriate financial reporting, under the Internal Control System Promotion Headquarters, we will establish internal control over financial reporting and evaluate its effectiveness.

- We will take a firm attitude against anti-social forces and groups that threaten public order and safety, and eliminate any relations with them.

- The Internal Auditing Division conducts audits on the status of compliance.

- System concerning the preservation and management of information on the execution of duties by directors

- Information concerning the execution of duties by directors shall be appropriately and reliably recorded and managed in accordance with laws and regulations and document handling regulations and stored in a state of high searchability.

- Directors shall be able to inspect the information at all times.

- To recognize the importance of information assets and to prevent information leakage, and loss, etc., we will undertake appropriate management under the Information Security Committee based on information security policy.

- Regulations and other systems concerning the management of risk of loss

- Based on the risk management regulations that systematically define risk management, we will manage the risks of the entire Company Group under the Risk Management Committee.

- We will analyze and evaluate risks at the Risk Management Committee, rationally manage risks, consider countermeasures, and continuously monitor risks.

- In case unforeseen circumstances occur, we will take prompt and appropriate response, prevent the expansion of damage, and develop a crisis management system to minimize the damage.

- The status of risk management is audited through the Internal Auditing Division.

- System for ensuring efficient execution of duties by directors

- In principle, the Board of Directors holds the meetings at least once a month and flexibly, at any time as necessary, so that they can accurately grasp the business execution status of each director and make management decisions swiftly and flexibly, and not only discusses the matters stipulated by laws and regulations and the important management matters and decides management policies but also supervises business execution.

- The execution of duties by each director shall be properly and efficiently performed based on the responsibilities, authority, and decision-making rules based on internal regulations such as the regulations of the Board of Directors, the regulations of division of duties, and the official regulations of administrative authority.

- System for ensuring the appropriateness of operations in a corporate group comprising a stock company, its parent company, and its subsidiaries

- We will share the SHIMA SEIKI Group Code of Conduct with the SHIMA SEIKI Group and promote compliance.

- We will provide guidance and support to group companies concerning business operations, and risk management, etc. through divisions who are responsible for the SHIMA SEIKI Group, in order to establish an efficient internal control system for the SHIMA SEIKI Group.

- We will strengthen the supervisory function and management system concerning the management of the group company as well as the Company's directors as officers of the group companies to share information.

- Based on the management regulations of affiliated companies, we will manage group companies through decision-making and reporting system of important matters to the company.

- The Company's Internal Auditing Division will perform internal audits of the business execution status of Group companies, compliance with laws and regulations and internal regulations, and risk management status, etc.

- Matters concerning employees who should assist Audit & Supervisory Committee in their duties

- The Internal Auditing Division shall assist the Audit & Supervisory Committee in their duties at the request of the Audit & Supervisory Committee.

- With regard to the duties required by the Audit & Supervisory Committee, the Internal Auditing Division shall not receive instructions or orders from the directors (excluding directors who are Audit & Supervisory Committee Members) and shall follow the instructions of the Audit & Supervisory Committee.

- System relating to reports to Audit & Supervisory Committee

- Directors, and employees, etc. of the Company and the SHIMA SEIKI Group will promptly report to the Audit & Supervisory Committee about the matters that seriously affect the business or performance of the Company and the SHIMA SEIKI Group, acts in violation of laws and regulations and the articles of incorporation, implementation status of internal audits, and reports through Corporate Ethics Helpline, etc.

- Regardless of the foregoing, Audit & Supervisory Committee may request reports from directors, and employees, etc. of the Company and the SHIMA SEIKI Group at any time as necessary, and those who are requested to report shall make a prompt respond.

- A person who made a report to Audit & Supervisory Committee shall not receive disadvantages due to the report.

- Audit & Supervisory Committee Members shall be able to attend important meetings in order to understand the status of business execution by directors.

- Systems for ensuring expenses arising on the execution of duties by Audit & Supervisory Committee Members, matters concerning policies relating to the settlement of debts, and effective audits by the Audit & Supervisory Committee

- When an Audit & Supervisory Committee Members has made a request for advance payment or redemption of expenses incurred in the execution of his/her duties, it shall promptly deal with such expenses or obligations, except in cases where it is deemed not necessary for the execution duties of such Audit & Supervisory Committee Members.

- In order to conduct an effective audit, Audit & Supervisory Committee Members may regularly hold an opinion exchange meeting with the Representative Director, the Accounting Auditor, and the Internal Auditing Division.

- Audit & Supervisory Committee can receive advice on their own independent audit service by outside experts.

Human Rights

We hereby set forth the Shima Seiki Group Policy on Human Rights and will promote initiatives to respect human rights out of a recognition that human rights may be affected, directly or indirectly, in the course of our business activities and in order to respect the human rights of all persons tied in any way to our business activities.

Shima Seiki Group Policy on Human Rights

We aim to become a company that is indispensable in society by pursuing the sustainable development of our business in accordance with our management philosophy of Ever Onward. We hereby set forth the Shima Seiki Group Policy on Human Rights (hereinafter referred to as the “Policy”) and will promote initiatives to respect human rights out of a recognition that human rights may be affected, directly or indirectly, in the course of our business activities and in order to respect the human rights of all persons tied in any way to our business activities.

- Basic concept

- As a member of society, we are cognizant of the importance of respect for human rights in all of our business activities. We support and respect human rights as set forth in the International Bill of Human Rights and the International Labour Organization’s (ILO) Declaration on Fundamental Principles and Rights at Work and will promote activities in accordance with the United Nation’s Guiding Principles on Business and Human Rights.

- Scope of the application of the Policy

- The Policy shall apply to all officers and employees (*) of the Shima Seiki Group. In addition, we shall require business partners and other concerned parties with any connection to the business of the Shima Seiki Group to respect and refrain from violating human rights.

※“All officers and employees” shall mean the directors and executive officers of Shima Seiki Group companies, persons in a labor relationship with a Shima Seiki Group company, and temporary employees working under a worker’s dispatching agreement concluded with a Shima Seiki Group company.

- The Policy shall apply to all officers and employees (*) of the Shima Seiki Group. In addition, we shall require business partners and other concerned parties with any connection to the business of the Shima Seiki Group to respect and refrain from violating human rights.

- Initiatives for respecting human rights

- Eradicating discrimination

We shall respect fundamental human rights and diversity and thus endeavor to maintain a healthy workplace environment free of inappropriate forms of treatment, such as discrimination and harassment based on nationality, race, creed, religion, sex, age, disability, social status, or other backgrounds. - Respect for employees

We shall respect the diversity, fundamental human rights, and the privacy of employees; endeavor to eradicate all forms of discrimination and work to eliminate child labor, forced labor, and harassment; manage appropriate working hours; ensure minimum wages; provide a safe and hygienic workplace environment; and respect the freedom of association and the right to engage in collective bargaining. - Taking business activities into account

We shall endeavor to maintain a responsible supply chain with our suppliers in accordance with the Shima Seiki Group Code of Conduct and our Basic Policy on the Procurement of Materials. In addition, we shall respect the privacy of our clients and work to ensure that we do not socially discriminate against our clients.

- Eradicating discrimination

- Practicing respect for human rights

- Due diligence in terms of human rights

We shall endeavor to prevent and mitigate any negative impact on human rights by building a framework of due diligence in terms of human rights and identifying and addressing any human rights-related risks that we pose to society. - Relief measures

We shall utilize a system for reporting concerns about human rights, promptly investigate any allegation of a human rights violation, and take corrective measures through appropriate internal and external procedures if it is clear that we have directly had a negative impact on human rights or played a part in having a negative impact on human rights. - Education

We shall provide officers and employees with appropriate education and training to ensure that the Policy is reflected in all business activities of the Shima Seiki Group. - Dialogue with stakeholders

We shall fortify initiatives for respecting human rights through good-faith dialogs and consultations with relevant stakeholders on measures to deal with any negative impact on human rights. - Information disclosure

We shall appropriately disclose information on the progress we have made with respect to initiatives for addressing any negative impact on human rights through our website, integrated reports, and other channels.

- Due diligence in terms of human rights

-

Mitsuhiro Shima

President

Shima Seiki Mfg., Ltd.

Enacted in December 2021

Compliance/Risk Management

Compliance

We aim to contribute to society through all business by executives and employees of the SHIMA SEIKI Group and set out a "Code of Conduct" that expresses guidelines to be observed comprehensively in each business activity based on the management philosophy. To achieve these objectives, we have formed a Compliance Committee, which conducts regular checks on compliance status and entrenches systematic compliance through induction courses.

SHIMA SEIKI Group Code of Conduct

- General Rules

-

Corporate Conduct Based on the Corporate Philosophy

We strive to become an indispensable company to the society through sustainable business development. We do this under the motto of “Ever Onward” with “love,” “creation,” and “passion” as our mantra.

-

Love:

We contribute to society through our creative craftsmanship, which is friendly to both people and the environment. We strive to contribute to society through love for our work, people, country, community and the earth.

-

Creativity:

We aim to create world's firsts through our finely honed sensitivity and sense of creativity.

-

Passion:

We tackle new challenges with passion and chart our own future course by putting our all into our products and services.

-

-

Compliance with Laws, Regulations and Corporate Ethics

As a member of the SHIMA SEIKI Group (the “Group”), and as a member of society, each of us will act in a sensible manner with the highest ethical standards.

In case of any act in violation of laws, regulations or corporate ethics, we will promptly respond to it and correct it, and take the appropriate measures to prevent its recurrence.

In conducting business activities in various countries or regions, we will respect the cultures, customs and other aspects of the relevant countries or regions, and comply with applicable local laws and regulations as well as social norms. Each of us will avoid any lack of transparency and act in a fair and sound manner as a member of the Group, which is always trusted by the society. We will endeavor to respect the International Code of Conduct in situations where the laws of each country or region or their enforcement do not provide appropriate protective measures to protect the environment or society. In a country where any of its national or local laws, or the enforcement thereof, is contrary to the International Code of Conduct , we will still strive to respect the International Code of Conduct to the utmost extent.

-

Corporate Conduct Based on the Corporate Philosophy

- Chapter 1. Business Activities

-

Development of Products with the Most Advanced Technologies

Aiming to grow with our customers, and based on the fundamental principle “that seeks to develop products with the most advanced technologies and offer them at the most affordable prices” through creativity and ingenuity, we will contribute to the development of the user industry through continuous efforts to create original products that anticipate customers’ needs.

-

Assurance of Product Safety

We will pay full attention throughout all of our business activities, including the development, manufacture and sales activities, to provide products and services that give full consid

-

Fair Public Relations Activities

We will provide accurate and fact-based information in our public relations activities to avoid causing any misunderstanding among our stakeholders such as customers, business partners, shareholders, government agencies, local communities, employees, etc.

-

Fair Transactions with Suppliers

We will treat suppliers of materials and services in an equal and fair manner in activities to procure such materials and services, and always carry out sound and transparent transactions with such suppliers by complying with laws and social norms on fair and proper transactions with cooperative companies while giving consideration to the environment and human rights.

-

Promotion of Fair and Free Trade

We will comply with all applicable laws, regulations and rules on fair competition and fair trade, and provide customers with products and services developed with the most advanced technologies at a fair price, through a fair and free market competition.

-

Promotion of Proper Import and Export Transactions

We will comply with applicable trade laws and regulations, and carry out the appropriate customs clearance procedures for import and export. Especially, with respect to national security, we will carry out a strict export control.

-

Appropriate Accounting Practice

We will comply with applicable laws, regulations and internal rules on corporate accounting, and properly and promptly implement accounting procedures and make accounting reports, thereby striving to enhance the transparency of management, and ensure the reliability of financial reports.

-

Protection of Intellectual Property, etc.

We will always be mindful of the fact that for the Group, which makes creation of unique technological developments as its principle, intellectual property rights are the main source of creating corporate value, and hence, we will strive for the proper protection and effective use of intellectual property rights.

-

Prohibition of Insider Trading

We will not unfairly trade stocks or other marketable securities by using non-public inside information of the Group or other companies that we have come to know in the course of the performance of our duties, before such information is publicly disclosed (insider trading).

-

Development of Products with the Most Advanced Technologies

- Chapter 2. Relations between the Company and Society

-

Contribution to Society

We will develop business activities beneficial for the society, including the development of useful products, and proactively promote corporate social responsibility activities or other related activities as a corporate citizen of society.

-

Information Disclosure

To achieve the proper understanding and trust of shareholders, investors, customers, local communities, etc., we will strive to disclose information in a fair, timely, appropriate and continuous manner with respect to business conditions or general corporate activities.

-

Initiatives for Global Environmental Protection

In order to protect the global environment, we will comply with environmental laws and regulations, actively promote environmentally friendly business activities, and contribute to the realization of a sustainable society.

-

Relations with the Government and Public Agencies

In relation to domestic and foreign politics and administration, we will comply with the relevant laws and regulations of each country and region, maintain sound and proper relationships, always increase transparency, and do not act in a way that is misleading.

-

Firm Attitude against Anti-Social Forces

We will take a firm attitude against anti-social forces and groups that threaten public order and safety, and eliminate any relations with them.

-

Contribution to Society

- Chapter 3. Relations between the Company and the Employees

-

Respect for Human Rights and Creating a Comfortable Working Environment

We will respect basic human rights and diversity, and strive to maintain a healthy working environment without discrimination or harassment based on nationality, race, beliefs, religion, gender, age, disability, social status, or any other improper treatment.

-

Prohibition of Various Types of Harassment

To secure and maintain a healthy workplace environment, we will not commit any act of sexual harassment such as unwanted or unwelcome sexual language or conduct offensive to other persons. In addition, we will not commit any act of power harassment by taking advantage of our authority in the workplace such as making the work environment of a co-worker difficult or causing a co-worker employment anxiety by constant language or conduct that denies the integrity and dignity of such co-worker and goes beyond the appropriate scope of work.

In addition, we will not engage in any other acts of harassment such as moral harassment.

-

Protection of Privacy

We will respect the privacy of individuals. We will handle personal information discreetly and manage it strictly.

-

Compliance with Employment Rules, etc.

We will comply with the Employment Rules and other internal rules.

-

Maintenance and Securing of Safe Workplace Environment

We will comply with laws, regulations and other rules on workplace safety and health, take the appropriate measures for security and disaster prevention at the workplace, and thereby maintain and ensure a safe and comfortable workplace environment.

-

Prohibition of Acts that Involve Conflicts of Interest

We will not commit any act that conflicts with the interests of the Group (act involving a conflict of interest) without obtaining the required approval through the appropriate procedure.

-

Respect for Human Rights and Creating a Comfortable Working Environment

- Chapter 4. Relations with Company Assets

-

Management of Confidential Information

We will appropriately manage and use the confidential information of the Group and prevent the external leakage thereof.

-

Appropriate Use and Management of Company Assets

We will appropriately and efficiently use and manage the company assets, whether tangible or intangible, and will not use the company assets for any purpose other than the performance of our duties.

-

Appropriate Use of Information Systems

We will make use of the information systems of the company as beneficial tools to enhance operational efficiency.

-

Management of Confidential Information

- Chapter 5. Other Provisions

-

Scope of Application

This Code of Conduct applies to all officers and employees of the SHIMA SEIKI Group. SHIMA SEIKI MFG., LTD. and its subsidiaries shall promptly adopt this SHIMA SEIKI Group Code of Conduct (including its amendments (if any)) as their own code of conduct at their respective decision making bodies such as boards of directors, and take the appropriate steps to ensure that it is read and understood by all of their respective officers and employees. Each company may amend or add provisions to this Code of Conduct to reflect the requirements of local laws and regulations or social customs in the relevant country or region, or the characteristics of its business operations, as necessary. However, no amendment or addition may contradict this Code of Conduct or be contrary to the effect thereof.

-

Scope of Application

(Supplementary provisions)

- Enforced on September 15, 2006

- Revised on July 18, 2008

- Revised on September 18, 2015

- Revised on March 1, 2021

- Revised on February 1, 2022

Internal Reporting Systemm

We set up a "Corporate Ethics Helpline" inside and outside the company as a reporting counter for violations of laws and regulations, violations of human rights, in-house fraud, etc. In addition to guaranteeing that the whistleblower will not receive disadvantages, it is also possible to report with anonymity.

Risk Management

A Risk Management Committee is established based on regulations systematically defined for risk management and the committee is held periodically. We created a system to continuously monitor risks through the Risk Management Committee. Furthermore, upon occurrence of serious events such as unforeseen circumstances or large-scale disasters, we will set up the Crisis Management Headquarters to respond.

Information Security Activities

In recognition of the importance of information assets, we establish an Information Security Committee to prevent leakage/loss of information, and we are engaged in activities to promote the use of appropriate information systems based on the information security policy.

Business Continuity Plan (BCP)

The SHIMA SEIKI Group established a system that can minimize interruption of business activities while ensuring the safety of employees, their families, and stakeholders even in the event of major disasters or accidents, while still fulfilling the responsibility to supply products to customers.

We are preparing emergency manuals assuming Tonankai/Nankai earthquakes, earthquake resistance measures of factory buildings, stockpiling of food, evacuation drills, employee safety confirmation system, etc.

Also, assuming the case that the company suffers a disaster, we will prepare to recover the business at the early stages. When a disaster occurs, we will launch the "Crisis Management Headquarters" based on the business continuity plan and respond promptly.

TOP>Company>Sustainability>Management